by James Kunstler on 13 October 2008 in jameshowardkunstler.com

The G-7 world, the club of "developed" western nations plus Japan, has commenced an ordeal of suddenly waking up much poorer. All the desperate work-arounds being engineered by governments and central banks on an al fresco basis are intended to overcome this stunning basic fact, and none of them will. The benchmarks of everything are in flux -- stocks, bond values and yields, commodity prices, most especially currencies -- but these tend to disguise the basic

fact of growing and spreading impoverishment. Is oil priced at $80 a barrel this morning? That's nice. Except if the company that employs you is about to fold up and you face a holiday season of driving frantically around Atlanta in search of another job, which the odds are against you find finding. Or if you're living on a retirement fund that's just lost 37 percent of its value and it's time to fill the heating oil tank.

Iceland is the poster-child du jour for this. The little island nation of about 320,000 souls (roughly half of Vermont's population) lately grew a banking sector that thrived on something-for-nothing finance. In little more than a month, its banks have imploded like mini death stars, leaving Iceland with a pariah currency. Since it has to import just about everything, and it suddenly finds itself unable to pay for imports, the people are stripping the grocery markets

of whatever remains there now. You wonder what they will do in two weeks. Ten years from now there may be 32,000 of them left, subsisting on blubber sandwiches.

I exaggerate perhaps a little, but who really knows where all this leads? Here in the USA, the Treasury, enjoying new and seemingly limitless powers of discretionary spending, has begun shoveling dollars into every truck that backs up to the loading dock. The numbers are staggering. In ten days it's reached into the trillions in loans and handouts. Most of this money is getting sucked directly into the black hole of debt and margin calls of one kind or another. This is

previously-presumed wealth that is now un-presumed. It's leaving the system, never to be seen again. One useful way of thinking about it is to regard it as our society's previous borrowings against our own future. Thus, we are seeing our future vanish into a black hole -- our future comfort, health, and basic nourishment.

This is the kind of fiasco that brings down governments, propels societies into revolutions, and starts wars. In a few months, America will be full of angry economic losers. We're not the same nation that crowded around the old radio consoles for Franklin Roosevelt's fireside chats. Back then, we were mostly a highly-disciplined, regimented, industrial society full of citizens who mostly did what they were told to do, and mostly trusted in authority. Today we're a nation

of tattooed barbarian "consumers" with no impulse control, a swollen sense of entitlement, ruled by a set of authorities ranging from one G.W. Bush to the grifter-billionaire pantheon of Wall Street CEOs -- now heading into secret bunkers with their stashes of krugerrands, freeze-dried veal Milanese, and private security squads armed with XM-8 carbines.

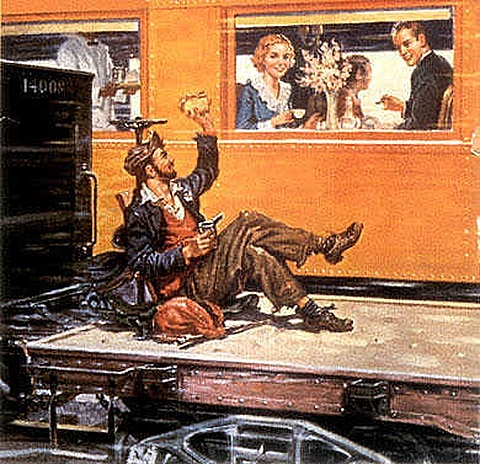

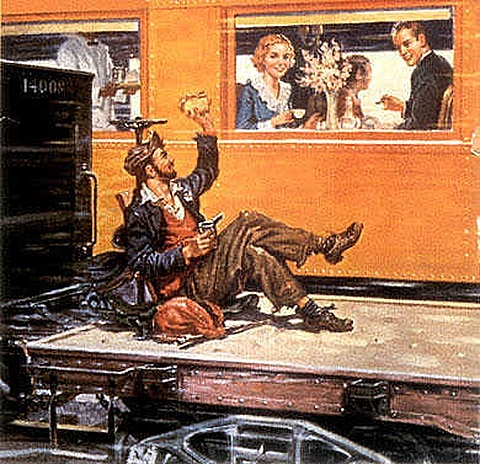

image above: Hobo rides freight and waves at well to do in passing dining car

I go along with Nassim Nicholas Taleb's idea -- read "The Black Swan" -- that nobody really knows anything. We construct our narratives to try and explain circumstances that are unraveling non-linearly before us, and some narratives are more plausible than others, depending on your vantage point. There are infinite narratives. This is nothing more than my narrative. The circumstances we're entering appear, for the moment, to take the shape of a compressive deflationary

depression with the cherry-on-top add-on of a hyper-inflation further down the road -- meaning initially that jobs, incomes, and pensions are lost, but that later on even the little money that people manage to get -- perhaps mostly from government hand-outs of one kind or another -- steadily loses its value. Every way you jigger things, it just ends up meaning the same thing: a much poorer society. It certainly won't be a society of recreational shoppers plying the Target

store aisles for scented candles and home accents. Hyper-inflation could make old debts meaningless, but it would also make credit meaningless and spending absurd.

Given the way our society has evolved to operate -- as an endless upward spiral of borrowings -- you can see an awful lot of things not working anymore, and an awful lot of people not working in them or at them. Maybe the governments of the G-7 will get lending unstuck at the upper levels, but who, exactly, is able to borrow now besides companies on the verge of bankruptcy -- and why continue to lend to them? (Except to maintain the pretense that "something is being

done.") Besides, there's much too much previously borrowed money that won't ever paid back, and the "work-out" of all that debt only implies the continued distress sale of any-and-all assets -- so that the USA in effect becomes yard-sale nation.

Personally, I think all the rejiggering in the world of numbers and indexes will not solve anything, and really only represents a kind obsessive-compulsive neurosis related to numerology that will do nothing to readjust our daily activities toward the production of things that have real and enduring value. In my narrative, the fate of industrial nations really depends on energy resources. The price of oil may be going down for the moment -- perhaps due to the deleveraging

of hedge funds, banks, and invested individuals, perhaps combined with a perception of "demand destruction" -- but the geology and geopolitics of oil have not changed since June of this year when oil was at $147. Let's say US oil consumption is down one million barrels of oil a day. Within the next two years, we're liable to lose more than that in import declines from Mexico and Venezuela alone.

The International Energy Agency's latest estimate is for only slightly less of an increase in worldwide oil demand than was previously posted. It's still a net demand increase. World oil consumption still exceeds world production now, perhaps permanently so. Finally, the current plunge of oil prices has suddenly halted the very capital ventures in exploration and development that were hoped to increase the worldwide

supply of oil. All this portends an aggravation of oil supply and allocation problems in the five years ahead, and ultimately much more expensive, harder-to-get oil.

What we can't face is the prospect that we might become something other than an industrial "consumer" society. My narrative includes the conviction that we will have trouble producing food for ourselves as petro-agriculture fails, and since society can't go on without food production, I see this activity coming back much closer to the center of our daily lives. We're not ready to think about that. The downside of our unreadiness may be that a lot of Americans

will go hungry in the decade ahead.

None of this is an argument for despair, by the way, but it certainly invokes the need for steeply revised expectations and serious attention to a national "to-do" list. We're on our way to becoming another nation, whether we like it or not. No amount of numerological augury or even hand-wringing will change that. The big question for, say, the 24 months ahead is: how disorderly will we allow this transition to be? |