POSTED: 1 JULY 2008 - 4:00pm EST

Worse Than Grandma's

Depression

image above: colorized version of "Young Mother

From Oklahoma Out In California" (1937) from

the depression era at www.makeuptalk.com

| by James Kunstler on 30 June 2008 in www.kunstler.com This isn't so funny anymore. Intimations of a July banking collapse rumbled though the Internet this weekend while mainstream news orgs like The New York Times and CNN pulled their puds over swift boats and Amy Winehouse's performance technique. Something is happening, and you don't know what it is, do you Mr. Jones...? to quote the master. What's happening is that American society is sliding into a greater depression than the one Grandma lived through. On the technical side, there has been unending controversy as to whether we're gripped by inflation or deflation. It's certainly deceptive. Food and gasoline prices are rising faster than the rivers of Iowa. But the prices of assets, like houses, stocks, jet-skis, GMC Yukons and pre-owned Hummel figurines are cratering as America turns into Yard Sale Nation. We're a very different country than we were in 1932. In that earlier crisis of capital, few people had any money but our society still possessed fantastic resources. We had plenty of everything that our land could provide: a treasure trove of mineral ores and the equipment to refine it all, a wealth of oil and gas still in the ground, and all the rigs needed to get at it, manpower galore (and of a highly disciplined, regimented kind), with fine-tuned factories waiting for orders. We had a railroad system that was the envy of the world and millions of family farms (even despite the dust bowl) owned by people who retained age-old skills not yet degraded by agribusiness. We had fully-functional cities with operating waterfronts and ten thousand small towns with local economies, local newspapers, and local culture. We had a crisis of capital in the 1930s for reasons that are still debated today. My own guess is a combination of a bad debt workout that sucked "money" into a black hole (since money is loaned into existence, but vanishes if the loans are not systematically paid back) plus a gross saturation of markets, meaning that every American who had wanted to buy a car or an electric toaster had done so and there was no one left to sell to. (The first round of globalism -- 1870 - 1914 -- had shut down after the fiasco of World War One.) Our debt problems today are of a magnitude so extreme that astronomers would be hard pressed to calculate them. By any rational measure our society is comprehensively bankrupt. From the federal treasury down to the suburban cul-de-sacs so much loaned money is either not being paid back, or is at risk of never being paid back, that the suckage of presumed wealth has passed through an event horizon out of the known universe into some other realm of space-time, never to be seen again in this realm. This would seem to be the very essence of monetary deflation -- money defaulted out-of-existence. This condition is partly disguised by both the loss of credibility of US currency and real-world scarcities of oil and food, but the upshot will be something at least twice as bad as the Great Depression of the 1930s: people with no money in a land with no resources (with manpower that has no discipline), hardly any family farms left, cities that are basket-cases of bottomless need, comatose small towns stripped of their assets and social capital, an aviation industry on the verge of death, and a railroad system that is the laughingstock of the world. Not to mention the mind-boggling liabilities of suburbia and the motoring infrastructure that services it. The banks have been doing their death dance for an entire year now, pretending that their problems are those of mere "liquidity" (i.e. cash-on-hand) rather than insolvency (no cash either on hand or in the vault and nothing else to sell to raise cash except worthless "creative" securities that nobody would ever buy). But the destruction of money (resulting from loans not paid back) is now so intense that the game of pretend has reached its terminal point. The question for the moment is exactly who and what will be crushed as these institutions roll over and die. Complicating matters is a global oil predicament that is really not hard to understand, but which the organs of news and opinion have obdurately failed to explicate for an anxious public. Call it Peak Oil. There are only a few elements of it you need to know. 1.) that demand has now permanently outstripped supply; 2.) that new discoveries are too meager to offset consumption; 3.) That under under the circumstances, the systems we rely on for daily life are crumbling. I've called this situation The Long Emergency. Our chances of mitigating this, and of continuing our current way-of-life is about zero. I've tried to promote the idea that rather than waste remaining resources in the futile attempt to sustain the unsustainable (i.e. come up with "solutions" to keep suburbia running), that we should begin immediately making other arrangements for daily life -- mainly by downscaling and re-scaling everything from farming to commerce to the way we inhabit the landscape -- but my suggestions have proven unpopular even among the "environmental" elites, who are too busy being entranced by new-and-groovy ways to keep all the cars running. So where we are at now is the equivalent of standing in the slop by the ocean shore under a gathering hundred-foot-high wave that is about to come crashing down on our heads. Since I sure don't know everything, I can't say how this will all play out in the months ahead, especially with the presidential election coming at the exact moment that voters will be turning on their furnaces for the cold and dark winter beyond. I would venture to say that so far our society as a whole has done a piss-poor job of comprehending the situation. But there is still the possibility, with four months of politicking left, that the nature of our predicament can be articulated in a way that few can fail to understand, the way Mr, Lincoln articulated the terms of the Civil War on the eve of its fateful outbreak. ______________________________ |

POSTED: 28 JUNE 2008 - 10:00am EST

A

fresh view of oil and mortage crisis

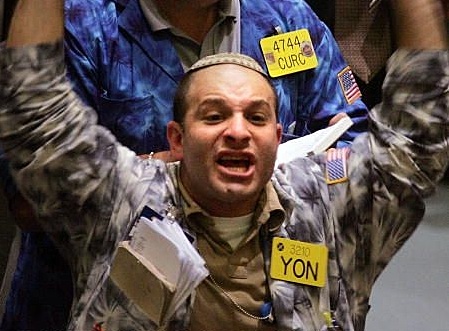

image above: Traders work in the oil futures pit at the New York Mercantile Exchange

[Note by James Kunstler: A very interesting letter from reader George Abert on oil and its relation to the finance fiasco.] by George W. Albert, AIA on 27 June 2008 in www.kunstler.com Once the price is bid up, it stays there until it is bid up again the following month. So if you take 10 percent of 85,000,000 barrels a day times 30 days in an average month times $5.00 you get a total of $1,275,000,000 in margin. With each month of these shenanigans, these banks can offset upwards of 12,000 subprime mortgages. Not a lot given that there may be upwards of 2,000,000 of these ticking time bombs, and considerably more if the banks fail to walk the razor’s edge they’ve defined

for themselves. At this rate, it will take over ten years to offset the bad debt portfolios and only if few of those who have investment accounts make withdrawals. At the rate of +$5.00 a month, the price for a barrel of oil in 2018 would probably be over $900. It will never get there! It’s reported that with Americans now paying around 11 percent of their income on energy, we are getting pretty darn close to the end of these shenanigans: in the 1973-74 time frame, the tipping point was reached when Americans had to pay more than 12 percent of their income for energy. When oil gets to $150/barrel in two to three months we’ll be past that point. |

see also:

Island Breath: Report from the Bank of Banks 6/28/08

Island Breath: The Shadow Bank System 6/20/08

Island Breath: Alternate Derivative Reality 6/5/08