Editorial on 10 July 2008 in The Wall Street Journal

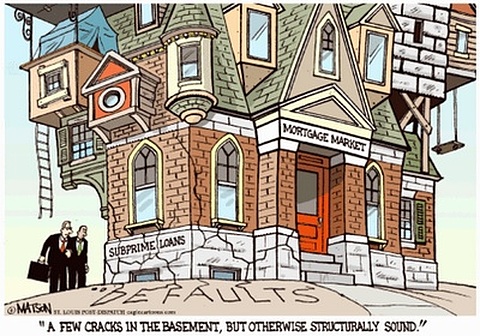

As opposed to GM or Ford, most Americans have never heard of Fannie Mae and Freddie Mac. Yet the insolvency of either mortgage giant would have far more profound consequences for every American taxpayer than the bankruptcy of those car companies. It's time Americans understood the price they could soon pay for the Beltway's confidence game with these high-risk 'government-sponsored enterprises.'

These columns have warned about Fannie and Freddie going back to 2002, and our fate has been to climb a wall of denial and hostility. This week reality began to set in. The duo's share prices tanked nearly 20% on Monday on fears that their capital levels may not be adequate. They rallied on Tuesday as their regulator played cheerleader, but they sank again yesterday to prices in the teens, compared to more than $60 a share last October. Investors are saying that a Bear

Stearns-like run on the companies is a real possibility, and they're right.

What Americans need to know is how damaging such a failure would be. This wouldn't merely be a matter of the Federal Reserve guaranteeing $29 billion in dodgy mortgage paper, a la Bear Stearns. Fannie and Freddie are among the largest financial companies in the world. Their liabilities – mortgage-backed securities (MBSs) and other debt – add up to some $5 trillion.

To put that in perspective, consider that total U.S. federal debt is about $9.5 trillion, compared to a total U.S. GDP of $14 trillion. About $5.3 trillion of that debt is held by the public (in the form of Treasury bonds and the like), while $4.2 trillion is intragovernment debt such as Social Security IOUs. This is the liability side of America's federal balance sheet, and its condition influences how much the government can borrow and at what rates.

The liabilities of Fan and Fred are currently not on this U.S. balance sheet. But one danger is a run on the debt of either company, putting pressure on the Treasury and Federal Reserve to publicly guarantee that debt to prevent a systemic financial collapse. In an instant, what has long been an implicit taxpayer guarantee for both companies would be made explicit – committing American taxpayers to honoring as much as $5 trillion in new liabilities. U.S. debt held

by the public would more than double, and the national balance sheet would look very ugly.

The companies have a stronger liquidity position than Bear, but investors are saying the chance of a collapse is greater than our politicians want to admit. With its share price decline this week, Fannie Mae's market capitalization is down to $15 billion. Yet at the end of the first quarter, the company had $42.7 billion in capital. Investors are saying that as a business Fannie is worth only slightly more than one-third of its capital cushion. Fannie's debt is also priced

at the highest spreads over Treasurys since 2000 – another sign of eroding confidence.

Freddie's market discount from its capital cushion is even worse. Its shares fell nearly 24% yesterday – to a market cap of some $6.8 billion. Yet its capital, at the end of the first quarter, was $38.3 billion. The message from markets is that both companies are in danger of exhausting their capital and becoming insolvent if home prices keep falling and mortgage losses mount.

Why is there so little Washington or Wall Street alarm about this? Because the politicians and financiers are part of the consensus that has long promoted the growth of Fannie and Freddie. Congress created the companies to spur home ownership and, in return, got an endless stream of campaign contributions and election support. Beltway elites like James Johnson and Jamie Gorelick made tens of millions working there. Wall Street marketed their MBSs to buyers around the

world, pitching them as virtually as safe as Treasurys (due to the implicit taxpayer guarantee) but with a higher return. Everybody made a bundle.

The assumption was that the taxpayer guarantee would never have to be honored, just as everyone before the savings and loan debacle thought deposit insurance would rarely have to be paid. But these political bills always come due.

The double irony amid the current credit crunch is that our politicians have been promoting Fannie and Freddie as mortgage saviors even as their risk of insolvency has grown. Chuck Schumer, Chris Dodd and many others have encouraged the duo to take on even greater mortgage risk as the housing slump has unfolded. They're the arsonists posing as firemen while putting more dry tinder around the blaze.

So how do we get out of this mess? The worst option would be to let the situation erode until the Fed and Treasury panic amid market pressure and issue an explicit taxpayer guarantee. The consequences from putting $5 trillion in liabilities on the federal balance sheet would raise America's borrowing costs and jeopardize the Treasury's AAA credit rating. The dollar could face greater selling pressure, especially if the Fed tried to inflate away this greater debt burden.

And all without a single Congressional appropriation or public debate.

Hank Paulson's Treasury is now pressing Congress to move quickly to create a new regulator with greater powers – not least to reassure Fannie and Freddie's borrowers. The question is whether this is too little, too late. Congress is refusing to set a statutory limit on their MBSs, though reducing this business and their debt is the only way to limit taxpayer risk. And under pressure from Congress, the regulator recently eased the companies' capital requirements.

Our own proposal, made months ago, is to require a more honest form of socialism by injecting taxpayer money now into both companies (say, in the form of subordinated debt or preferred stock) to recapitalize them enough to weather the current storm. This would help prevent a U.S. balance sheet debacle, and it would force the politicians to acknowledge the mess they have created. Then as the crisis passed, the taxpayers would at least get something for their money, while

regulators could work to unwind Fan and Fred's liabilities and shrink these monsters to a less dangerous size.

This would be real 'change' in Washington. Instead, the political class continues to promote the status quo illusion that Fannie and Freddie are risk-free purveyors of the American housing dream. It is one of the great political scandals of our age, and it has unfolded in broad daylight. As usual, the American taxpayer will get stuck with the bill.

|