by Judy Dalton on 6 December 2006

Many states are experiencing a sudden increase in ethanol production. A coal-fired ethanol plant is proposed for Kauai, and if approved, it would be the first one in Hawaii.

The Sierra Club does not support ethanol production as an element of a long-term, sustainable energy system. Please open attachment at the end of this letter to read Sierra Club's comments to the Department of Health. (DOH)

Coal-fired plants have been successfully opposed by citizens throughout the country. If there is enough public input to the DOH it could encourage them to require an Environmental Assessment (EA) or possibly an Environmental Impact Study (EIS) for this coal-fired plant. Since it would be the first in the state it is within right of the DOH to advocate a different energy source.

Life of the Land's Henry Curtis commented, "The state will react if enough people speak out. Right now the state is attempting to steamroll this project through. There needs to be a thoughtful, balanced, and thorough analysis of biofuels...Replacing oil with coal-based ethanol because taxpayer subsidies make it economical while not accounting for associated climate change impacts may heat the planet by entities who think they are promoting sustainability."

Below is a letter from Henry Curtis describing the coal-fired ethanol plant that is proposed for Kauai. Please write a few lines to the Department of Health regarding this important issue. The costs to our health, air quality, water quality, and land resources could outweigh any benefits of ethanol production. As always, it's the number of responses that matter, so you can keep it short and simple with talking points below. Please note that letters must be postmarked

by this Saturday, December 9.

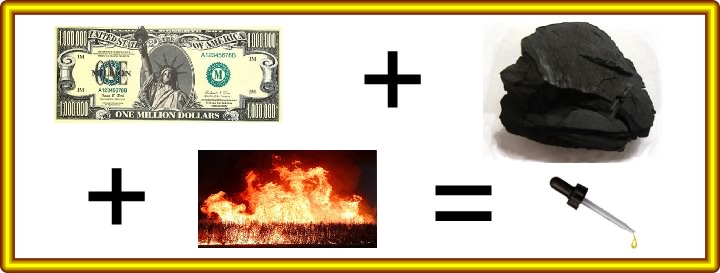

Kauai Ethanol (aka Maui Ethanol) wants to build a coal plant to make ethanol (from molasses). The ethanol would be sold as a green renewable energy. Each gallon of ethanol produced would require 4.18 pounds of imported Australian Coal. About 1/8 of the molasses would come from the Kauai's Gay & Robinson plantation, the rest would come from another island, state, or country.

According to Kauai Ethanol, their ethanol plant and Gay & Robinson's steam generator, to be located next door to each other, will be treated as two totally separate facilities for the purpose of meeting EPA's emission regulations. The KE ethanol plant will produce greenhouse gases and other noxious air pollutants.

''Hawaii's Gay & Robinson, one of just two remaining sugar operations in the Aloha State, will receive a major financial boost — a 30-cents-a-gallon refundable ethanol-production investment tax credit for eight years, courtesy of the state. ''In effect, the state is building the plants for us,'' Alan Kennett, Gay & Robinson's president, said Tuesday of the credit that will amount to $36 million. ... Kennett was one of four panelists who discussed ethanol

and sugar's role At the 23rd International Sweetener Symposium in North Carolina, Asheville, N.C.'' (Palm Beach Post. August 09, 2006)

Renewable Energy must mean producing a renewable fuel by green methods. It does not mean converting coal, oil, gas or nuclear power into a renewable fuel and then selling the end product as green. Such a conversion is ''green washing'' or ''fuel laundering'' and will do nothing to make the planet sustainable or to limit greenhouse gas emissions. True cost must require ''Cradle to Grave'' or ''Life Cycle'' accounting processes that evaluates all financial and non-financial

costs.

SEND COMMENTS TO:

Clean Air Branch Department of Health

919 Ala Moana Boulevard, Room 203

Honolulu, Hawaii 96814

Regarding: Covered Source Permit 0620-01-C Kauai Ethanol

Docket No. 06-CA-PA-21

All comments must be postmarked or received by December 9, 2006.

Comments on the draft permit should address, but need not be limited to, the permit conditions and the facility's compliance with federal and state air pollution laws, including: (1) the National and State Ambient Air Quality Standards; and (2) HRS, Chapter 342B and HAR, Chapter 11-60.1.

Henry Curtis

Please click on to Life of the Land's comments here to get ideas for your letters:

http://www.lifeofthelandhawaii.org/Kauai%20Coal%20Plant.html

Consumer Reports published an enlightening article in its October issue entitled "The Ethanol Myth". Click onto below:

http://www.consumerreports.org:80/cro/cars/new-cars/ethanol-10-06/overview/1006_ethanol_ov1_1.htm

If you're interested in still more talking points, here are a few gleaned from a Sierra Club web site. Or just skip down to the end of this email to Hawaii Chapter's testimony which is included as an attachment.

Concerns about the Environmental Impacts of Ethanol Production

A brief synopsis relating ethanol production effects to proposed coal-fired plant on Kauai by Judy Dalton

Combustion Coal Power Plants

Coal provides about 50 percent of all electric power in the U.S. Coal-fired power plants alone are responsible for about 10 percent of global greenhouse gas emissions.

There is no such thing as “clean coal.” The coal fuel cycle, from mining to coal sludge impoundments and disposal of tailings and fly ash, causes extensive pollution of air, water, land, the food chain and local communities. The Sierra Club opposes the use of coal as an energy input for ethanol production.

Air Quality

Particulates emitted from coal-fired plants can cause serious health problems for at-risk populations.

Particulate matter is a generic term used to describe microscopic sized soots and aerosols. Because small particles can penetrate the deepest parts of the lungs, exposure increases the likelihood of symptoms in sensitive individuals, including children, the elderly and those with heart and lung disease.

Mercury Pollution

Coal-fired facilities also emit methylmercury, a developmental toxin. The primary exposure pathway is through fish and shellfish and the animals that eat those fish. Mercury is not a by-product of combustion.

Rather, very small amounts of mercury are present in coal and are vented through the exhaust system when the coal is burned. It is unclear just how far mercury travels in the air before falling to the ground.

However, with a coal-fired facility so close to the ocean as it would be on Kauai, it is inevitable that aquatic life and ultimately humans will be exposed to this dangerous toxin.

Water Resources

The quantity of water could diminish since ethanol plants use an exorbitant

amount of water. According to the Renewable Fuels Association, processing the product and cooling equipment requires 3 - 4 gallons of water for each gallon of ethanol produced.

Landfilling Waste

Coal as a fuel source produces fly ash that must be disposed. Although concrete companies may be willing to purchase the fly ash, the industry requires the material meet a certain quality standard for it to be valuable. If fly ash does not meet the standards required of the concrete industry, this waste would only contribute to problems our landfill is already experiencing.

SOURCE: JUAN WILSON juanwilson@mac.com

POSTED: 6 December 2006 - 7:00pm

Give Green, Go Yellow

by Tom Philpott on 6 December 2006 in Grist Magazine

How cash and corporate pressure pushed ethanol to the fore

... got all liquored on that road house corn ...

-- Tom Waits, "Gun Street Girl

"Before it became widely used as a car fuel, ethanol was just grain liquor -- and the federal government was not particularly kind to it. We pledge allegiance to ADM.

Shortly after the American Revolution, the new government imposed a draconian tax on the stuff, hoping to pay down wartime debt. Instead, it got the Whiskey Rebellion of 1794, an insurrection eventually put down by forces led by President Washington himself. Similar hostility -- including the indignity of Prohibition, the 1920s-era federal ban on alcohol production -- marked official attitudes toward ethanol until 1978.

That year and thereafter, however, the government warmed considerably to "white lightning," as the 200-proof elixir is sometimes known. Rather than tax ethanol heavily, the government now lavishes it with tax breaks. Rather than ban production, the government subsidizes it. And commercial ethanol production, which withered away after World War II, now booms.

Why the change in fortune?

ADM CEO Dwayne Andreas

Ethanol's revival is intimately linked to one company, the giant grain-trading firm Archer Daniels Midland, and one seemingly unrelated product, high-fructose corn syrup. The story centers on a man who arguably counts as corporate America's most generous and influential political donor of the second half of the 20th century, former ADM CEO Dwayne Andreas. To understand the weird and lucrative nexus between an industrial sweetener, a gas substitute, and a grain magnate,

we need to go back to the days of disco.

By the late 1970s, Decatur,Illinois based ADM was already one of the most politically connected companies in the United States. The ultimate agribusiness, ADM ran a powerful network of grain elevators and mills throughout the Midwest. Along with its more demure rival Cargill and a handful of other firms, ADM was and remains the middleman between farmers and the food-processing companies and confined-animal feedlots that turn U.S. grain into the stuff that stocks supermarkets:

bread, Twinkies, breakfast cereal, and meat.

ADM won friends and influenced people by spreading its largesse across the political spectrum. CEO Andreas gained legendary status as a double-dealer during the Watergate investigations, when the congressional hearings revealed that he had cut the $25,000 check used by Richard Nixon's "plumbers" to finance the famous hotel break-in. From the same hearings it emerged that in 1968, Andreas had illegally donated $100,000 to Minnesota Sen. Hubert Humphrey --

Nixon's Democratic opponent in the 1968 election, and a longtime Andreas favorite.

Andreas earned a solid return on his promiscuous generosity. The grain titan is widely credited with convincing President Nixon to initiate and provide financing for an historic $700 million sale of U.S. grain to the Soviet Union in 1972 -- a deal for which Archer Daniels Midland played the profitable role of middleman. The sale had a dramatic and lasting effect on U.S. agriculture. The resulting spike in demand, exacerbated by a drought the following year -- sent

grain prices surging. High grain prices rippled through the U.S. food system, helping (along with the 1973 OPEC oil embargo) to spark the "stagflation" that gripped the U.S. economy into the next decade.

In the resulting political fallout, the U.S. Department of Agriculture felt pressure to bring down food prices. To do so, the agency radically transformed farm policy that had been in place since the New Deal. Since that time, the government had kept a floor under prices by paying farmers to store excess grain during bumper-crop years, so as not to flood the market. In years with poor harvests, stored grain would be released, thus holding prices down.

Pushed by Nixon's USDA chief Earl "Rusty" Butz, the 1973 Farm Bill essentially dismantled these New Deal mechanisms. In place of price supports, Butz famously exhorted farmers to plant "fencerow to fencerow" -- that is, as much as possible. Rather than keep a floor under prices for farm goods, the USDA would now lavish farmers with direct payments. That meant that if the market price for a good fell under farmers' production costs, a government

check to the farmer would make up the difference. This policy switch marks the birth of the subsidy system that remains controversial today.

A sweetheart deal

Predictably, throughout the rest of the 1970s, farmers managed to churn out more and more corn -- and prices fell. This effect benefited large traders like Archer Daniels Midland, because it meant lower input prices. But ADM could only squeeze a profit from bargain-priced farm goods if it could find a market for those goods. With grain production outstripping demand, the company began to actively seek ways to profitably move the nation's grain surpluses from farms

into food-processing factories.

In the mid-1970s, ADM had begun tinkering with a method developed in Japan for making a concentrated liquid sweetener out of corn -- high-fructose corn syrup -- that might appeal to the booming soft-drink industry. The process involved what's known as "wet milling" corn -- the same process ADM uses to this day for making ethanol.

The problem was that even with corn trading at rock-bottom prices, ADM could not make high-fructose corn syrup cheaply enough to compete with sugar. To overcome this obstacle, ADM succeeded not in the lab but rather in the political arena. Like a Midwestern Machiavelli, Andreas came up with an ingenious plan: finance lobbying efforts by Florida sugarcane growers to convince Congress to impose a quota on foreign-produced sugar, which had been flooding the U.S. market

and keeping prices down.

The strategy was as bold as it was ironic: push your rivals' legislative agenda and use it to snag business from them. It worked brilliantly.Is ethanol the real thing?

Soon after sometime free-trade champion President Reagan (another significant beneficiary of ADM largesse) gained office in 1981, he enacted a strict quota on foreign sugar. The price of sugar skyrocketed -- and suddenly ADM syrup became the cheaper option. Soft-drink makers now scrambled to switch. High-fructose corn syrup has since come to dominate the U.S. sweetener market. The controversial sugar quota, meanwhile, remains in place.

But ADM's triumph in the soft-drink market created another problem, one the company had already anticipated: Demand for Coca-Cola and other chilled, sweetened beverages rises in the summer and drops in the winter. Having invested heavily in wet-milling facilities, ADM could ill afford to let them idle in down months. What it needed was another profitable wet-milled corn product to pick up the slack in the winter.

That product was ethanol

If ADM could build robust markets for high-fructose corn syrup and ethanol simultaneously, it could make a fortune from the flood of cheap corn flowing from U.S. farms in the era of "fencerow to fencerow" production and generous subsidies. But if building a market for high-fructose corn syrup was as simple as engineering a sugar quota, gaining traction for ethanol proved trickier. At first glance, ethanol presented problems similar to that of the industrial

sweetener. In short, the company could not produce it cheaply enough to compete with gasoline. Once again the answer was legislative, not technical.

In his seminal 1995 study of ADM for the Cato Institute, "A Case Study in Corporate Welfare," James Bovard claims that in 1978, as oil prices soared in response to a Middle East crisis, Dwayne Andreas approached President Carter with a plan for energy independence: jumpstart ethanol production with a tax break. Andreas had been a major donor to Carter's campaign, and the Georgia politician had already demonstrated his allegiance by appointing an Andreas

crony to the Commodities Futures Trading Commission, a decision that sparked controversy.

Declaring energy independence the "moral equivalent of war," Carter pushed through Congress the Energy Tax Act of 1978, which exempted gasohol (gasoline blended with 10 percent ethanol) from the 4 cent per gallon federal excise tax, amounting to a 40 cent per gallon subsidy to ethanol.

But that coup didn't succeed in making ethanol competitive with gasoline. One problem was capital costs. As a new industry, corn wet millers such as ADM faced the need to make risky investments in new plants at a time of high interest rates. Another problem was Brazil, which was ramping up its own ethanol program, using sugarcane rather than corn as a feedstock. Since ethanol production involves converting simple sugars into alcohol, sucrose-rich sugarcane makes a

more efficient feedstock than corn. Thus Brazilian producers were able to undercut their U.S. competitors.

Andreas' response was simple and effective: lean on Carter for government-backed loans for ethanol plants and a stiff tariff against Brazilian ethanol. In the final weeks of a bruising campaign against free-market crusader Ronald Reagan, Carter did both: he announced $340 million in loans for new ethanol plants, and a tariff that essentially blocked Brazilian ethanol from entering the U.S.

Carter lost the election, but ADM's agenda survived. The "gasohol" tax exemption remains in place (it now amounts to 51 cents), Brazilian ethanol remains effectively blocked (although it has trickled in recently because of shortages in U.S. supplies caused by eagerness to use ethanol to replace MTBE), and ADM's feedstock of choice, corn, remains the nation's most-subsidized crop.

The synergy with high-fructose corn syrup, backed by the sugar quota, proved critical. In the mid-1990s, low oil prices made ethanol particularly unattractive for gas blenders, and ethanol demand stagnated. In those same years, demand for high-fructose corn syrup rose steadily, offsetting sluggish ethanol performance.

Even so, ADM could not resist the temptation to further manipulate markets. In 1996, after the FBI stumbled upon stark evidence that ADM had conspired to fix the price of lysine, a by-product of the wet-milling process used in animal feed, the company was forced to pay a $100 million fine (then a record). Eventually, three ADM executives served time in federal prison, including the company's one-time heir apparent, Michael Andreas (Dwayne's son). Later, in a civil

case stemming from the same time period, the company paid $400 million to settle a class-action suit for fixing the price of high-fructose corn syrup.

Your tax dollars at work

Despite its legal snafus, ADM moved into the new millennium with its political clout intact. George W. Bush has diligently maintained the four pillars of ADM's business model: heavily subsidized corn production, a stiff tariff against foreign ethanol, the sugar quota, and ethanol's tax exemption. He even signed off on a fifth pillar, for good measure: The Energy Policy Act of 2005 stipulates that the U.S. gas supply must contain at least 7.5 billion gallons of renewable

fuel by 2015, about double the 2005 level. Since corn ethanol has a vast head start over rivals, most analysts assume the mandate will mainly affect corn ethanol production.

Soon after taking office in 2001, Bush displayed his fealty by tapping Chuck Conner -- then-president of an ADM front group called the Corn Refiners Association -- as his "special assistant to the president for agriculture, trade, and food assistance." In 2005, Conner became deputy secretary of agriculture.

ADM, meanwhile, has thrived. The company's third-quarter 2006 financial statement testifies to the strength of the business model built by Andreas. Its corn-processing division (read: ethanol and high-fructose corn syrup) generated $290.5 million in operating profit, up from $136.2 million a year earlier. From ethanol alone, the company earned $177.5 million. Overall, the company churned out $575.2 million in profit for the quarter. That means that ethanol and corn

syrup -- two business lines that wouldn't exist without heavy and persistent government support -- supplied half of the company's profit.

Just how much does government manipulation on behalf of ADM's twin corn-processing units cost U.S. taxpayers and consumers? That's a tricky question, because the subsidy programs are so indirect and complex. For example, the corn subsidies that have kept ADM's feedstock of choice cheap for so long don't go to the company, but rather farmers. Nor does the sugar quota involve direct payments to ADM. Consumers pay the tab in the form of higher food prices. In addition

to these difficulties, several states and even municipalities have put in place policies that favor corn processing.

In a landmark study this year for the Geneva-based International Institute for Sustainable Development, researcher Doug Koplow attempted to come to terms with the situation. Here's how he described the "major challenge" of quantifying the value of government support for ethanol and other biofuel: "Virtually every production input and production stage of ethanol and biodiesel is subsidized somewhere in the country; in many locations, producers can tap

into multiple subsidies at once."

After 50 pages of detailing seemingly every one of those supports, Koplow reaches his estimated bottom line: total government support for ethanol clocks in at somewhere between $6.3 billion and $8.7 billion per year.

Let's crunch numbers here. ADM controls a third of the ethanol market, so (taking Koplow's lower estimate) let's say it benefits from about $2 billion in government largesse. If we use its third-quarter profit report as a base, ADM can be expected to make about $700 million in profit from ethanol over the next year. That means that every dollar in profit ADM makes from ethanol costs the public about $2.85. Note that Koplow's analysis doesn't even attempt to reckon

with the sugar quota, which has played such a powerful role in corn ethanol's ascent.

Nor is that vast public investment doing much to reduce carbon emissions, the most powerful case for government support for alternative energy sources. According to Koplow, for every metric ton of CO2 displaced by corn ethanol use, the government pays $500 in subsidies. For the same amount, the government could buy "more than 140 metric tons of [carbon] removal on the Chicago Climate Exchange, or more than 30 metric tons on the European Climate Exchange."

So What?

One plausible response to these tales of influence peddling and corporate welfare might be, "So what?" Call it a case of you-can't-make-an-omelet-without-breaking-a-few-eggs: Because of the chicanery of Andreas and his kept politicians, we now have a viable biofuels industry as we head into an era of climate change and tight petroleum supplies.

Yet for this rationalization to make sense, one has to assume that conventional corn-based ethanol, which currently accounts for 95 percent of U.S. biofuel consumption, is a mere transitional strategy. Few deny that corn ethanol, with its marginal net energy balance and fertilizer-reliant feedstock, is a net environmental liability. Cellulosic ethanol, which converts not just simple sugars but complex carbohydrates locked inside fibrous plant matter into alcohol,

could utilize crops that are much more environmentally benign than corn, including, famously, switchgrass and other annual, low-input grasses.

Indeed, under current law, cellulosic ethanol -- which has yet to be produced at commercial scale -- will draw even more government support than its conventional counterpart, which is why many companies, including ADM, are scrambling to bring it to market.

But there's a catch. ADM is by far the largest ethanol producer. Its market share dwarfs its largest competitor. And it has signaled its determination to maintain corn -- for which it has billions of dollars in assets geared toward buying, moving, storing, and processing in place -- as the main ethanol feedstock, even in a switch to cellulosic.

At a mid-October address to a renewable-energy conference in St. Louis, Mo., ADM's new CEO Patricia Woertz -- a former executive for the oil giant Chevron -- affirmed her company's commitment to corn in the coming cellulosic age. Declaring that "corn ethanol ... will continue to account for a significant percentage of biofuels for years to come," Woertz revealed that the company's main cellulosic push involved "waste" from the corn harvest.

But in farming terms, corn stalks and other residues aren't waste at all. Left in the field to rot, they mitigate the erosive quality of intensive corn production, which has done so much damage to the Midwest's precious topsoil. Woertz's remarks signal a plan for even more intensive soil mining there.

It should be noted, too, that ADM also dominates the small but growing U.S. biodiesel market, and also ranks as the No. 1 biodiesel producer in Europe, where use of the fuel is much more substantial. ADM will thus have a powerful say in choosing the main feedstock for biodiesel. Depressingly, the company favors another heavily subsidized crop, soybeans, for which it's the largest U.S. buyer. According to the Worldwatch Institute, soy has the lowest fuel-yield per

acre of any major biodiesel crop.

The lesson here, I think, is that for biofuel to become a serious response to the climate-change crisis, its political economy will have to be transformed. One company can't be allowed to dominate decisions and manipulate public resources in service of its own bottom line, rather than the broader public good.

|